Sales Procedure Guide

02 // What we do and how that supports our partners

Sales Procedure Guide

02 // What we do and how that supports our partners

Evolution supports partners in many aspects of their business, including technology, processes, systems and support. This section gives details on each of these, explaining how they work and what they deliver to consumers, as well as some feedback from existing partners we thought might be of interest.

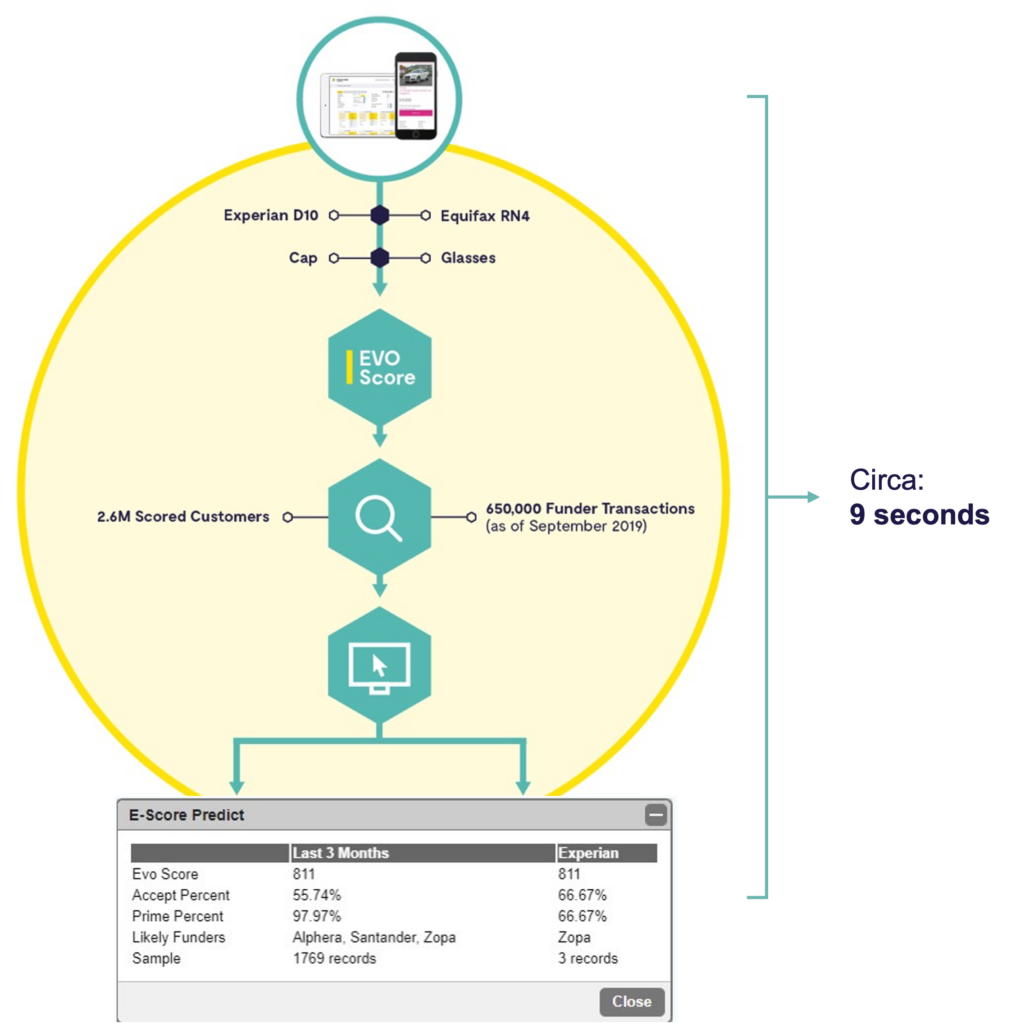

Algorithm: The Engine

Every proposal received into our platform is soft searched on both Equifax and Experian where score data, full CAIS, alias, associate and linked address data is obtained.

The combined data from the 2 main credit bureaus used by the majority of lenders in motor finance is then passed through Evolutions unique algorithm to produce an “Evo Score”. This score along with the specific characteristics and demographics of the proposal are washed across Evolutions transactional data from our historic book containing millions of actual lender interactions to accurately predict the likely outcomes and lenders for any given proposal and powers a host of functionality within our product and proposition.

Underpins

- Proposal Auto-routing

- R4R Aggregator

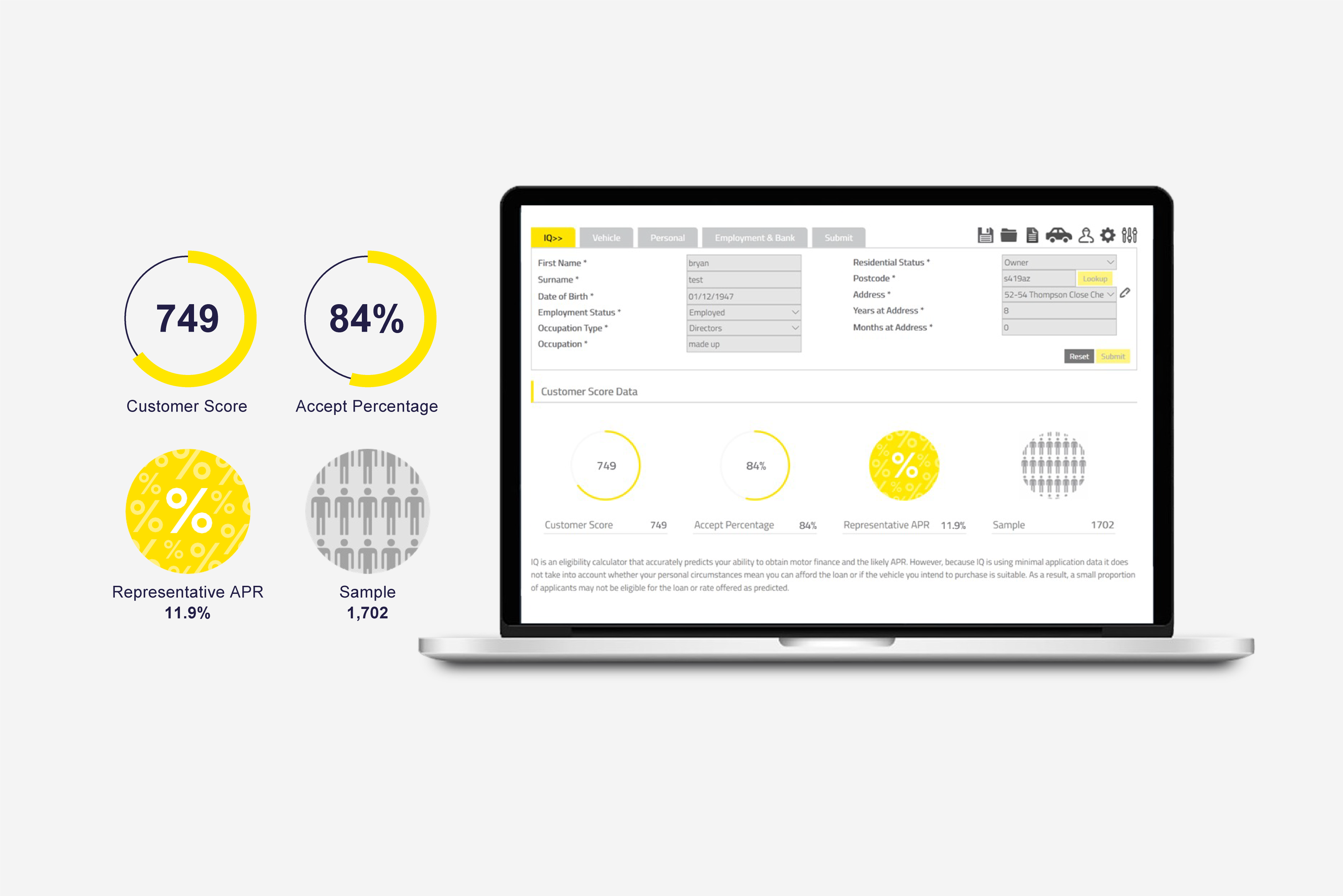

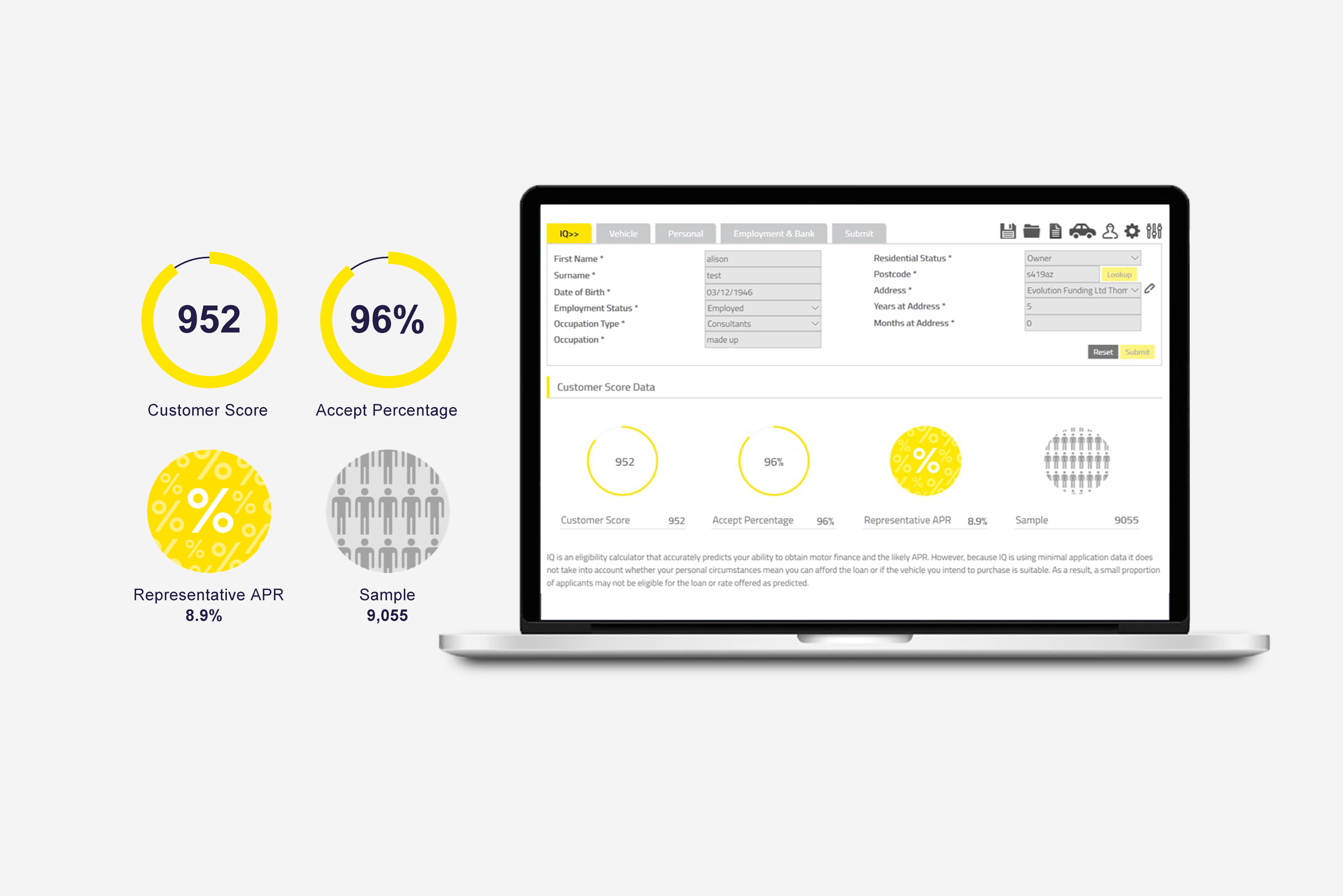

- IQ – Showroom Screening

- MCCS – Customer Web Screening

- API or Plugin – Web Calculators & Application

- Complete dealer finance platform

Delivering Credit Score-Based Pricing

Dealers are able to access the Evo Score and eligibility predictions via our point-of-sale system or our API from a soft search with minimal customer data required allowing for pre screening of customers in the showroom and segmenting customer journeys based on the results and likely outcomes.

Varying APR by score, banding customers into APRs appropriate for their credit risk enables you to offer a competitive and suitable rate only to those whose risk justifies it.

Case Study

Supporting Sytner to deliver the UK’s first ‘buy online’ used car purchasing journey

Digital Finance API or DealerZone DLP

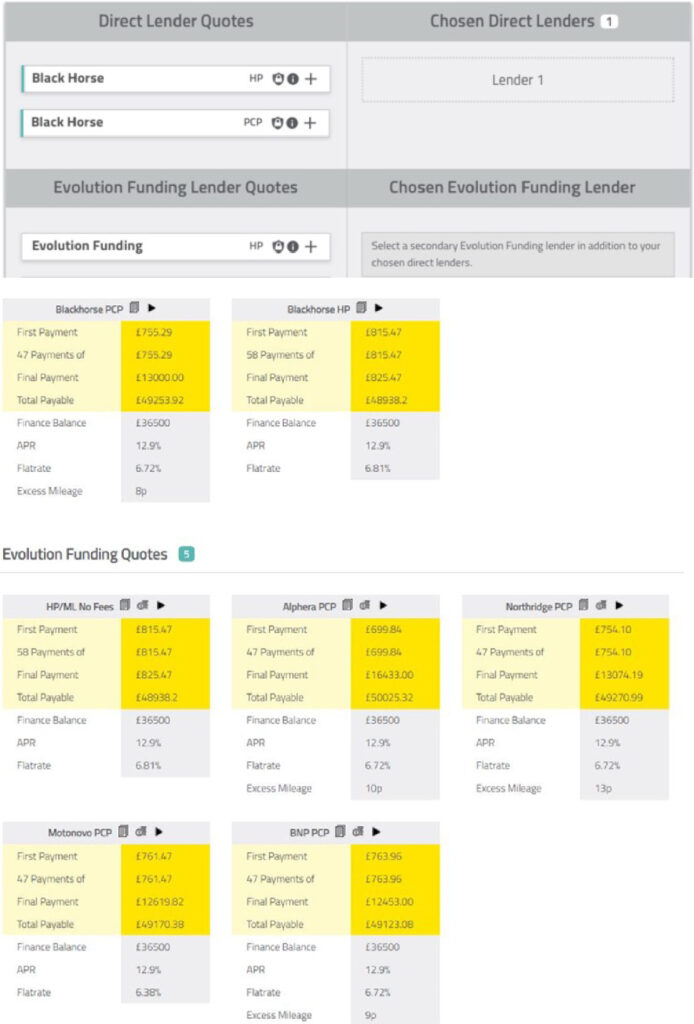

Evolution’s platform can be used by partners to access multiple lenders whilst still maintaining their direct commercial relationship.

Via our point-of-sale system or our API partners can quote, propose and transact with their main primary lenders with declined proposals then being submitted to our broker panel.

Case Study

Seamless delivery of a credit score-based pricing pilot for Vertu Motors.

With more franchises than any other group in the UK and the largest Honda supplier in Europe, Vertu Motors sits in the Top 5 of UK car dealership groups.

Vertu reported an overall increase in finance penetration, with some dealerships seeing an increase of over 20%. This aligned to an increase of over £100 in F&I profit per unit.