Financial Promotions Guide

2.2 // Representative APR

Financial Promotions Guide

2.2 // Representative APR

What is a representative APR?

This is the Annual Percentage Rate (APR) that you would reasonably expect at least 51% of credit agreements to be entered into as a result of a financial promotion, at the date it is advertised. Your representative APR is not the average rate that your finance customers received.

The representative APR must be shown as “% APR” and used with the word “representative”.

You must be able to show that the rate quoted in the financial promotion is representative. If you deal solely with Evolution Funding, then your Account Manager should be able to help you.

Show your working:

- If you had 100 finance customers and listed them in order of APR received from lowest at the top to highest at the bottom, the representative APR would be the one that is 51st on the list.

- This would demonstrate that at least 51 of the 100 customers (51%) received that APR or lower.

When must a representative APR be shown?

As per CONC 3.5.7R (1), a financial promotion must include the representative APR if it:

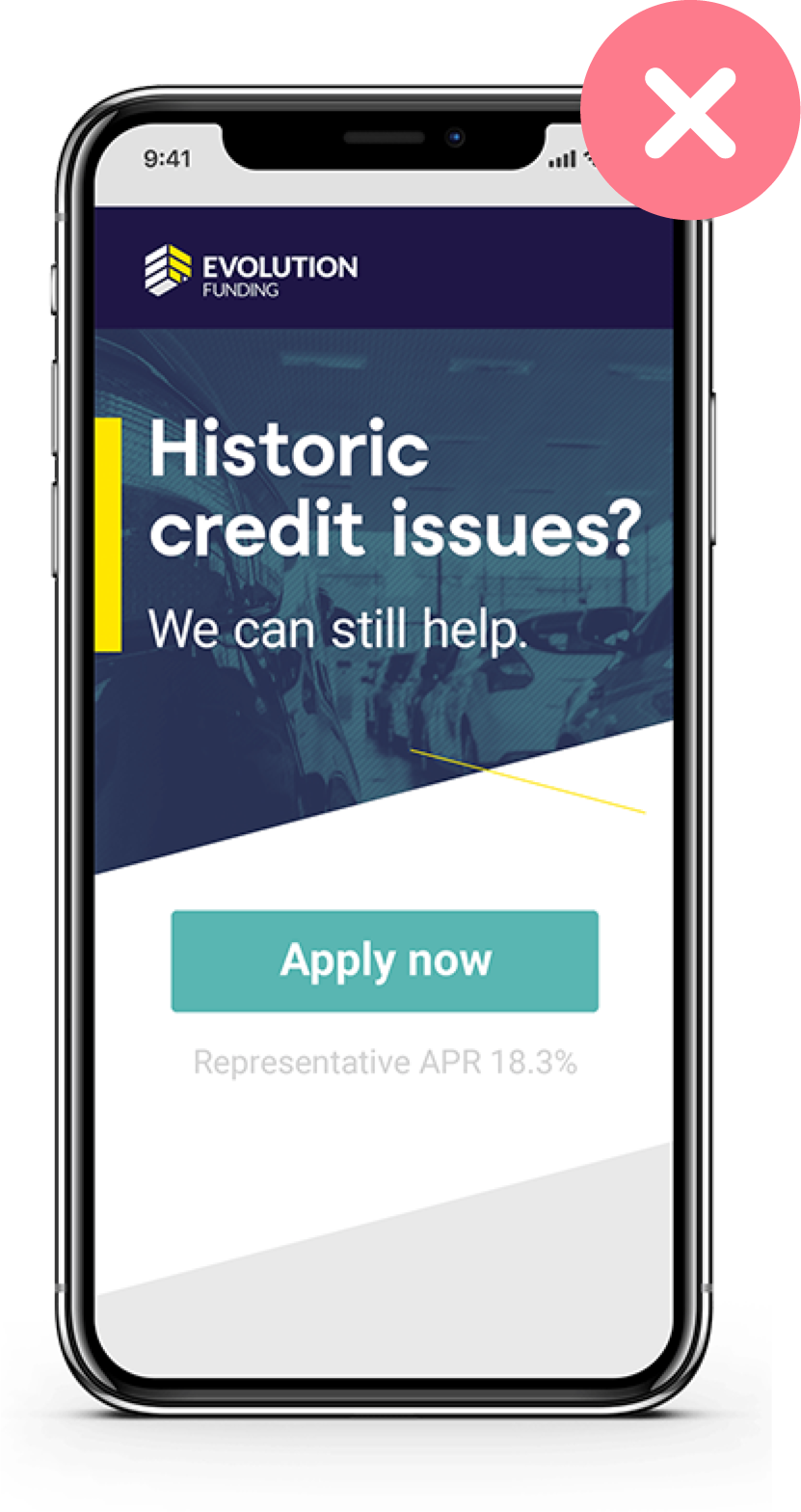

- States or implies that credit is available to people who might otherwise think their access to credit is restricted.

- Includes a favourable comparison with another person, product or service, whether the comparison is clear or implied.

- Includes an incentive to apply for credit, or to enter into an agreement where credit is provided.

Examples of 'trigger' wording:

- “Been refused credit?”

- “Struggle to get credit?”

- “Do you have CCJs and find it difficult to obtain credit?”

- “Lowest rates ever”

- “Lowest rates until…

- “Lower rates than…”

- “Quick and easy application for credit”

- “Zero deposit required”

How to use

Click the green slider arrows and scroll left and right to see the compliant versus non-compliant examples.